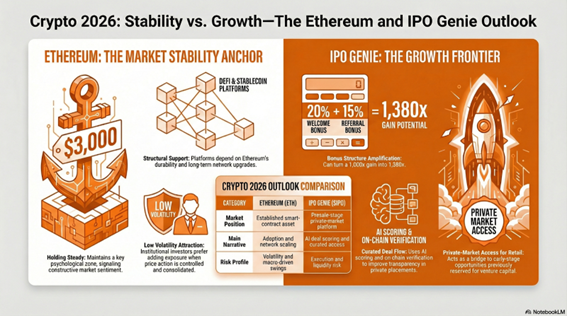

Ethereum (ETH) is trading near the $3,000 mark after a week of controlled swings, a sign of stability in a market that often moves fast. At the same time, IPO Genie is making steady progress in its Phase 42 fundraising, supported by a blockchain project, where private-market gains often happen long before a public listing. Importantly, both stories reflect the same theme: capital prefers clarity when sentiment is mixed.

Key takeaways

Ethereum is holding near $3,000 as traders watch liquidity, sentiment, and network headlines.

The $3,000 area remains a key psychological zone for ETH, with a clean break above or below likely to shape short-term bias.

IPO Genie’s Phase 42 activity keeps it in focus among early-stage buyers watching 2026 presales.

Presales and tokenized private-market strategies carry real risk, including volatility, liquidity limits, and regulatory changes.

Ethereum Holds Near $3,000 As Sentiment Stays Constructive

Ethereum’s price has been steady because the market has not seen a sudden risk-off shock. In addition, larger investors often prefer to add exposure when volatility is controlled, not when charts look disorganized. As a result, ETH consolidations around major levels can act like a pressure gauge for broader sentiment.

Still, Ethereum is not moving on price action alone.

Network progress,

scaling adoption,

and long-term upgrade expectations

remain part of how many analysts frame ETH’s durability.

However, upgrades do not guarantee price appreciation, and crypto markets can turn quickly when macro liquidity tightens.

Meanwhile, Ethereum’s role is also structural. Many stablecoins, DeFi platforms, and tokenized assets still depend on the Ethereum ecosystem in some form. Therefore, a calm ETH often supports a calmer market, even when smaller tokens remain volatile.

What investors are watching next for ETH

If ETH holds above $3,000 for multiple sessions, traders may treat the level as support.

If ETH falls back and fails to recover quickly, momentum traders may reduce risk.

If institutional flows and on-chain activity improve together, sentiment often strengthens.

IPO Genie’s Phase 42 Draws Attention for Private-Market Access

Live Presale: ipogenie.ai

IPO Genie is often described by commentators as a presale built around access, not slogans. The central claim is simple: big companies rarely start big, and much of the value jump happens before the public market ever sees the story. Therefore, IPO Genie positions itself as a bridge to curated early-stage and pre-IPO opportunities, with smaller minimums than traditional venture routes.

IPO Genie’s story mirrors a familiar pattern. Uber and Airbnb were valued in the low millions during early stages, then grew into massive public-market stories later. Likewise, Stripe’s early rounds were not open to most retail investors. As a result, IPO Genie frames its platform as a way for regular participants to get earlier visibility and earlier participation, based on project disclosures.

Importantly, the project also keeps the user message short. The whitepaper describes a three-step flow:

In addition, IPO Genie highlights on-chain records and verification as a way to improve transparency compared with opaque private placements.

How IPO Genie Raises Steady Funds in Phase 42

IPO Genie’s Phase 42 progress looks steady because the project keeps its message clear across each stage: private markets are big, most retail investors are shut out, and $IPO is the entry to curated deal access. This consistency helps reduce confusion and supports ongoing participation.

Visibility has also helped. IPO Genie has referenced an airdrop campaign, seasonal offers like Black Friday 30% and Christmas 25% on IPO Genie products, and the Misfits Boxing sponsorship in Dubai. These do not guarantee outcomes, but they help explain why interest stayed active through later phases.

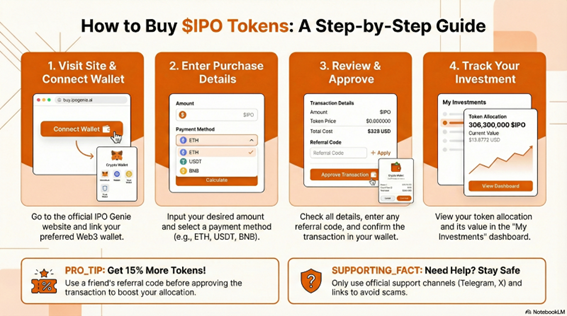

Also, IPO Genie offers

20% Welcome Bonus: Rewarding new users on the platform (still active)

15% Referral Bonus: Bonus for referrer and the inviter, creating a network-driven upside (still active). How to join the referral code in detail, you can read this.

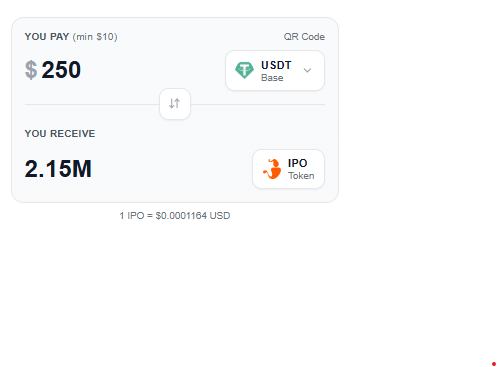

For example, if you buy the $IPO at the current price, a $250 purchase gives you 2,147,766.32 $IPO tokens.

The 20% welcome bonus adds 429,553.26 tokens = 2,577,319.58 $IPO tokens

Add one 15% referral bonus adds 386,597.94 more tokens = 2,963,917.52 $IPO tokens

Same investment. More tokens. Limited time.

If the price of $IPO reaches 1000x its current value

The Calculation

Current Price: $0.00011640

1000x Price: $0.1164

Your Tokens: 2,963,917.52

Total Value

2,963,917.52 × $0.1164 = $345,000

With Bonus Effect

Because of the 20% welcome bonus and the 15% referral bonus, your $250 investment did not just grow by 1000x. It effectively grew by 1,380x.

Under a standard 1000x move, $250 would normally become $250,000.

By using the bonus structure, that same $250 reaches $345,000, adding $95,000 in extra value at the same price target.

According to the recent report, an analyst says $IPO is the most compelling bitcoin alternative, so that’s why investors are rushing to join it.

A Clear Comparison for January’s 2026 Investor

Category | Ethereum (ETH) | IPO Genie ($IPO) |

Market position | Established smart-contract asset with broad usage | Presale-stage token tied to a private-market access platform |

Current focus | Price stability near $3,000 and sentiment signals | Phase 42 fundraising and product buildout |

Main narrative | Adoption, scaling growth, and long-term network progress | AI deal scoring plus access to curated private-market style opportunities |

Risk profile | Volatility and macro-driven swings | Presale risk, execution risk, liquidity risk, and regulatory uncertainty |

Common use case | Core market exposure | Higher-risk early-stage exposure tied to platform traction |

Why $IPO Stays on Best Crypto Presales Watchlists

Best crypto presales often look for two things: a clear use case and a blockchain project that fits the current market mood. IPO Genie positions $IPO as a utility token tied to tiered access, low fee, staking rewards, and governance participation. It also connects higher tiers to added perks, including stronger deal priority features described in its materials.

There is also a timing factor. When majors like Ethereum trade calmly, attention often spreads to early-stage projects with a clearer product plan. This does not make presales safer. Still, it explains why IPO Genie remains part of watchlist discussions among people comparing risk and upside.

Where & How to Buy $IPO in the Presale

IPO Genie directs presale participation through its official purchase page: buy.ipogenie.io

Closing View For January 24, 2026

Ethereum’s stability near $3,000 reflects a market that is calmer than it was during peak volatility periods. However, calm majors often lead investors to search for early-stage opportunities with clearer product stories. As a result, IPO Genie’s Phase 42 progress is gaining attention among buyers who prefer a project built around access, screening, and on-chain verification.

For readers tracking Crypto news and trying to stay positioned in 2026, the contrast is straightforward. Ethereum remains a core network asset, while IPO Genie is a presale project linked to a private-market access model and an AI deal scoring framework.

So, if you missed the early-stage entry of Ethereum, don’t be sad, its you second chance, you can join the best return presale in Q1 2026.

If you want to join the token best crypto presale for Q1 2026. Then, IPO Genie is the best early-stage pick with high upside.

Join the High Potential Presale for Amazing Rewards with Just $10!