Concurrently, focus redirects toward Zero Knowledge Proof (ZKP) for framework-based factors. ZKP gets examined through how its regular involvement structure immediately establishes value creation and distribution, substituting quick-profit exploration with a framework producing results from genuine blockchain movement.

SOL ETFs Resist the Pattern While Funds Shift Away from Bitcoin

Among the most remarkable progressions throughout the selloff stood Solana's comparative resilience in exchange-traded instruments. Solana spot ETFs registered $3.08 million in total deposits throughout a timeframe when the majority of digital holdings experienced forceful withdrawals.

This creates pointed opposition to Bitcoin, which witnessed $483 million in total ETF withdrawals while participants reduced risk during macro confusion. Ethereum, alongside majority major-value holdings, pursued a comparable direction, strengthening the importance of SOL's difference.

From a market framework viewpoint, this holds significance since ETF movements usually show institutional strategy instead of everyday investor attitude.

Why Solana's Blockchain Movement Stays Strong

The present blockchain measurements validate the ETF story. Regardless of the selloff, Solana's network movement has stayed notably steady.

Based on the information:

Solana created 8.6 million fresh addresses

Accompanied by 8.4 million, a reduction of merely 2.38%

This degree of steadiness throughout a wide market reduction carries significance. Fresh address development generally shows genuine application and arriving interest, excluding short-term quick trading. The reality that address expansion scarcely shifted indicates that participant interaction hasn't substantially decreased.

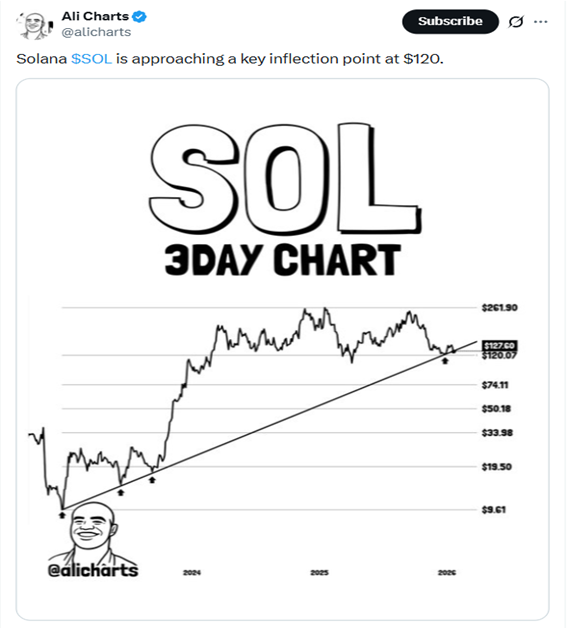

Important chart thresholds for observation:

$125: Main protection, currently structurally significant

$132: Initial barrier, recovery required for direction stabilization

$136: Advancement area for a limited rebound

$119: Decline objective if $125 breaks

A maintained advancement past $132 strengthens the positive recovery situation.

Understanding Zero Knowledge Proof's Purpose

ZKP represents an infrastructure-centered blockchain created to allow checkable calculation at scale. Its structure permits complicated workloads to be processed and confirmed blockchain-based with encryption accuracy, creating suitability for programs requiring results to be demonstrably correct without depending on centralized confidence.

Presale Auction Involvement Establishes ZKP's Value Daily

Zero Knowledge Proof functions on a basically distinct valuation process. ZKP doesn't depend on transaction records, supply reserves, or quick-profit offerings to establish initial value thresholds. Rather, value creation gets powered immediately by regular involvement patterns.

Daily, ZKP launches a fresh blockchain-based presale auction opportunity. A set supply gets allocated for that period, and individual participant's distribution gets determined fairly based on their input compared to the complete movement for that opportunity.

This generates a valuation framework including:

Zero set participation value

Results relying on genuine involvement, excluding timing

Regular refreshes block continued benefits

Distribution staying clear and checkable blockchain-based

In basic language, ZKP's value daily doesn't get explored through exchanging, yet develops naturally from shared involvement actions.

Understanding This Significance for Initial Investors

Zero Knowledge Proof's flexible valuation approach holds significant effects for initial investors. ZKP compensates for comparative interaction within individual regular patterns.

For investors, this presents a distinct type of market reasoning:

Initial stages function beneath reduced involvement concentration

Distribution gets powered by movement, excluding quick trading

Zero framework benefit for major holders or exclusive stages

Regular refreshes guarantee equal circumstances throughout the duration

While involvement grows across duration, rivalry naturally climbs, and subsequent participants confront stricter distribution circumstances. This creates initial participation as a purpose of network exploration instead of promotional excitement.

Final Summary

Solana's present configuration shows a market in which institutional focus and genuine application differ from immediate-term value weakness. ETF deposits throughout a wide market decline, joined with steady blockchain-based expansion, indicate that SOL maintains framework protection even while macro circumstances stay delicate.

ZKP displays a distinct category of chance completely. Its regular presale coin price patterns eliminate standard quick-profit processes and substitute them with an involvement-powered distribution framework. Rather than exchanging unpredictability, initial investors position around framework shortage and clear allocation reasoning.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Auction: http://buy.zkp.com/

Telegram: https://t.me/ZKPofficial

Frequently Asked Questions

1. Why does Solana maintain strength regardless of the market selloff? ETF deposits and steady blockchain-based movement indicate continued institutional focus and genuine network application, even while values decline.

2. How does ZKP's valuation approach? ZKP's value gets established regularly through blockchain-based involvement, showing distributions determined fairly determined by complete movement daily.

3. Why does initial involvement matter for ZKP investors? Initial stages function beneath reduced involvement concentration, indicating that distribution circumstances grow more challenging while network recognition expands.