Typically buy-to-let investors stuck to the bigger capitals of London, Paris or even Madrid. With the advent of Airbnb, the arrival of thousands of relocated foreigners and developers investing in the rehabilitation of the once dilapidated buildings, not forgetting the millions of tourists discovering Portugal’s capital, that reality changed, and. Furthermore, government fiscal and residence by investment incentives added to an already attractive proposition.

According to Rodolfo Reis of the local business newspaper Jornal Económico, new builds have seen a 7% increase in sales prices. Last week, the Financial Times ran a story on rising house prices in many major economies, with Lisbon’s rental prices increasing at a rate of 2% in 2020 compared to 2019, alongside Berlin and Munich, a percentage point higher than Paris and Athens. The FT reported on the value of the industry across Europe today: “The market capitalisation of Europe’s publicly listed residential property sector has grown from €3.5bn in 2006 to nearly €85bn at the end of July this year, according to the European Public Real Estate Association.” Portugal, particularly Lisbon, is at the heart of this growth.

In Lisbon, a relatively small capital city with the most charming or historic districts being limited in space, demand continues to pull away from supply in the prime residential market with existing homes selling well even in 2020 and an increase in purchases on plan. Demand for houses vs apartments is up by 51% in 2021 compared to the first semester of 2020.

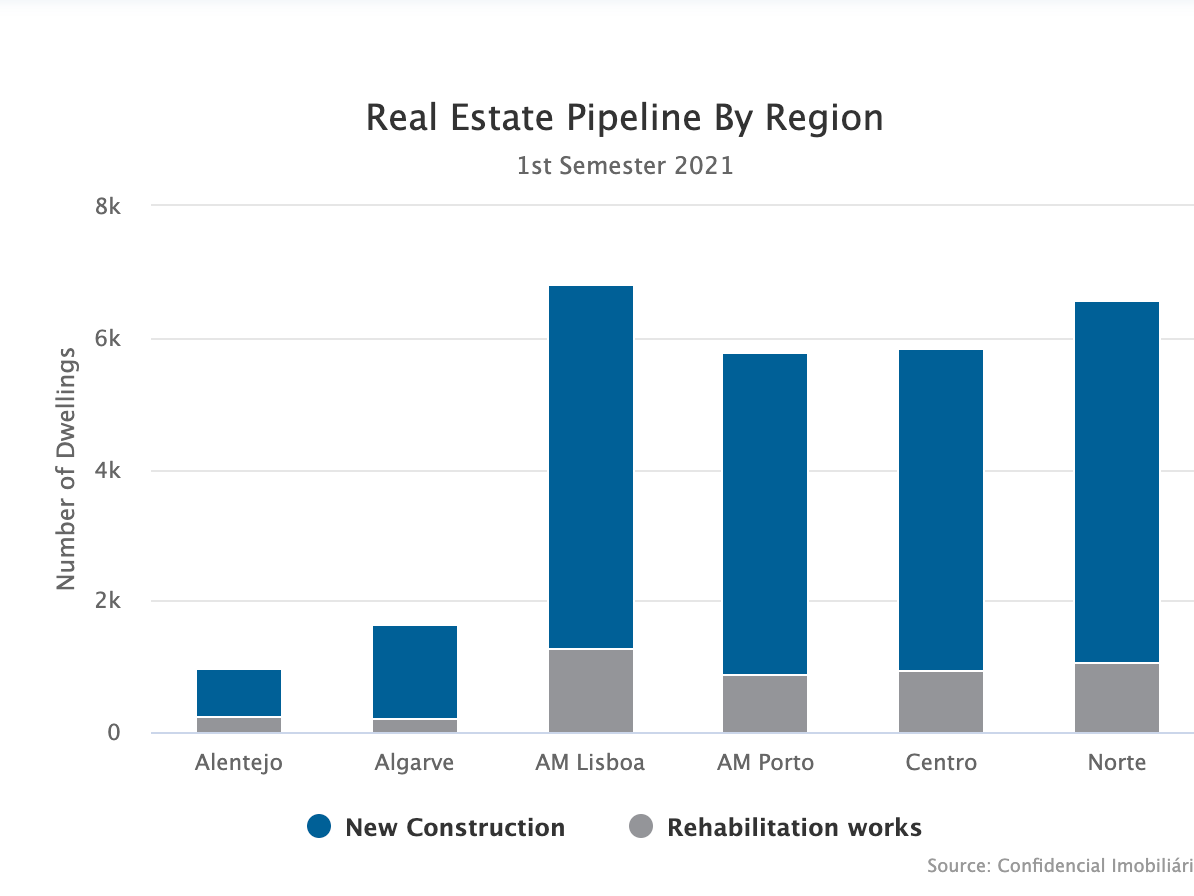

According to the Portuguese market intelligence firm, Confidencial Imobiliário, residential projects in the pipeline are up by 20% in the first six months of 2021 compared to the same period in 2020, with this week’s report revealing an increase in developments of houses 25% higher than the levels seen pre-pandemic in 2019 suggesting that demand for space is a priority after Covid-19.

Developers are warning market players that prices for raw materials are soaring, from timber to steel, and to expect a hike in final prices as a result. Builders are putting an expiry date of under a month to their budgets as a result, before new prices must be estimated. In June, Diário Imobiliário reported the cost of construction for new builds having increased by 6.5%. This emphasises the need to consider developers with good track records as well as strong balance sheet when buying off plan.

Besides consumer-led demand for heightened sustainability in every build, pandemic-induced or climate-aware investors are on the rise increasingly demanding eco-friendly practices seep into every level of the real estate sector. Portugal is no exception. Lisbon was voted Green capital of Europe in 2020, and developers are heeding to the call to use more sustainable materials and energy efficient systems.

Most real estate companies out of Lisbon, Quintela & Penalva | Knight Frank and Remax Collection as reported in the Portuguese press that local investors remain their biggest in volume. However, with the Golden Visa applications for residential purposes coming to an end in January 2022 in the main cities of Lisbon and Oporto and along the coastline, the number of nationalities seeking approval for their home purchases has increased sharply. Brazilians and French are still in second and third place respectively in overall volume for many real estate companies, followed by the British and the Chinese.

According to JLL, the market continues to record levels of attractiveness. YoY analysis regarding the investment volume in Q2 shows an increase of more than 200% from 2020 to 2021. Cushman & Wakefield’s most recent market analysis stated that institutional investment picked up in Q2 with €354 million transacted in this quarter of 2021, a year-on-year increase of 66%, taking the H1 volume to €556million.

The Portuguese economy contracted by 7.6% in 2020 due to the global pandemic. Portugal’s Economy Minister, Pedro Siza Vieira told Reuters in May that he expected growth to surpass OECD’s forecast of 4% in 2021. Cushman & Wakefield’s investment report released last month reported Moody Analytics forecast of 5.4% GDP growth for Portugal in 2022. Much is aligning in Portugal’s favour indicating a period of steady and consistent growth is to come.

We can arrange a briefing via Teams

The Market Pulse study for Q2 2021 by real estate company JLL Portugal indicates that the price in €/sq m in Lisbon’s prime locations stand as follows:

Chiado / Principe Real 8,500

Avenida da Liberdade 10,500

Historic Zone 7,000

Lapa / Estrela 6,500

Riverside 6,000

Campo d’Ourique/ Amoreiras 6,500

Avenidas Novas 6,500

Estoril 8,000

Cascais 10,000