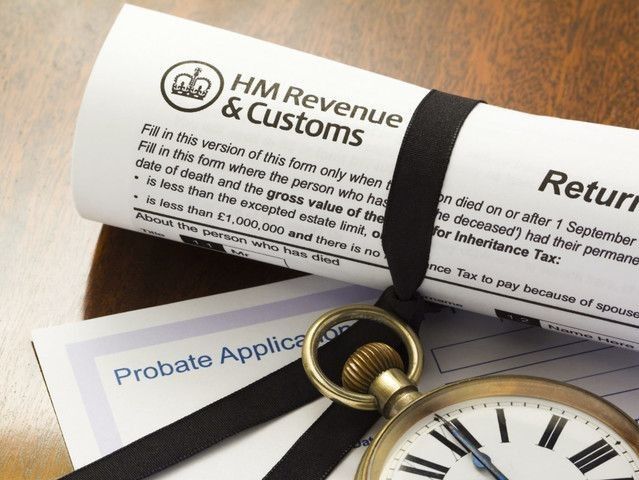

Which inheritance jurisdiction should I use?

Since the introduction of EU regulation 650/2012, you can use your Will to nominate which country’s law should govern the management of your estate. In Portugal if you intestate (without a Will) or your Will is deemed to be invalid, the ‘forced heirship’ laws may apply. The Government will decide how your estate is divided up and will distribute a minimum of 50% to your estate to your legitimate heirs – spouse, biological and adopted children, parents and grandparents. If there is more than one legitimate heir, then the percentage will be at least 60%. This affects not just Portuguese property, but all your worldwide assets, excluding non-Portuguese real estate. Under UK law, for example, the rules are quite different, so you need to decide which inheritance jurisdiction to use.

Should I have 2 wills?

If you make a Will but you already have a Will in another country, it could invalidate the first Will. If you move to Portugal, it’s wise to seek the advice of Will specialist so that you can be certain that your desired outcome for your assets can be reached. Whilst UK Wills are valid in Portugal, remember that managing probate cross-border can make the process longer and more complicated. You may find that it is cheaper to make a Will in Portugal rather than have your UK Will translated into Portuguese. Any Portuguese resident foreign national can make a Portuguese Will leaving their property to the person of their choice. This Will must be accepted by the Central Wills Registry (Registos Centrais) in Portugal.

How can I reduce inheritance tax?

Speaking to a financial advisor can help you to mitigate the tax bill when you are planning what to do with your assets. Instead of inheritance or succession tax, Portugal charges a 10% ‘stamp duty’. This only applies to Portuguese assets, mainly property, passed on as an inheritance or lifetime gift, irrespective of where the donor or beneficiary is resident. Although spouses and direct family – the legitimate heirs - are exempt from paying this Stamp Duty tax, partners who are neither married nor in a civil partnership will be liable for stamp duty on Portuguese assets inherited or gifted between each other, as will step-parents and step-children. However, after two years of living together, a couple can be considered married for tax purposes if they have informed the Portuguese authorities. Legally adopted children will also be recognised as direct family. Be aware that gifts of property can still attract UK inheritance tax depending on how long you have been non-UK resident.

Another option to protect your assets may be to create a company to mitigate inheritance and succession taxes. This can be quite complex, and you would need to understand the intricacies of capital gains tax and corporation tax, so make sure to get advice from your trusted financial advisor and tax accountant.

Advice from Blacktower Financial Management

Minimising the tax bill for your loved ones enables them to make the most of the gifted assets you leave them. Blacktower Financial Management wealth advisors can assess your situation, helping you to identify the best way to structure your wealth and your Will to minimise inheritance tax and Portuguese Stamp Duty. We will regularly review your position to ensure that your wishes can be carried out and you stay informed about the impact of any legislation or regulations changes. Contact one of the representatives at our Lisbon office today for your free no-obligation discussion.

Blacktower in Portugal

Blacktower’s offices in Portugal can help you manage your wealth to your best advantage. For more information contact your local office.

Antonio Rosa is the Associate Director of Blacktower in Lisbon, Portugal.

Blacktower Financial Management has been providing expert, localised, wealth management advice in Portugal for the last 20 years. We can help with specialist, independent advice on securing your financial future. Get in touch with us on (+351) 214 648 220 or email us at info@blacktowerfm.com.

This communication is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice form a professional adviser before embarking on any financial planning activity.